Your Gateway to Italy: Exclusive Hotel Investment

HOTEL RENOVATION INVESTMENT OPPORTUNITY – VENICE, ITALY

Address: 30174 Venice (Venezia)

Rooms: 28

Operator: European hotel brand (operating portfolio of 5,000+ rooms in 50+ hotels in Southern Europe)

Renovation schedule: Estimated 6‑12 months

Post‑renovation category: Upper (4-star superior)

Structure: 24 investors · €250,000 equity per investor · Total capital raised: €6 M · 100% equity financing (no debt)

Lock-in period: 10 years (early exit with penalty posible after 5 years)

Yield guarantee: 3% annual from hotel operation

Profit sharing: On sale of asset, 40% of value appreciation is distributed between the shareholders

Operational lease: 25‑year rental contract, of which 15 years obligatory

MARKET CONTEXT & STRONG FUNDAMENTALS

Tourism & Hospitality in Italy

In 2025, the Italian tourism sector is forecast to record over 481 million visitor nights, up approximately 3.3% from 2024.

Accommodation nights grew by +4.7% in Q2 2025 vs Q2 2024.

Luxury and upper-tier accommodations now represent ~28.8% of all overnight stays in Italy.

Top Italian cities, including Venice, show strong ADR (Average Daily Rate) growth versus 2019, confirming pricing power.

Venice Specifics

Venice recorded 5.66 million overnight visitors in 2023, with foreigners making up 86.1% of arrivals.

Hotel sector nights have nearly recovered to 2019 levels (-2.5%), while vacation rentals surged +11% CAGR (2013-2023).

The UNESCO Report recommends limiting new hotel development in the historic centre, supporting scarcity and pricing growth.

Implications for Investors

Stable demand & strong pricing in luxury hotels.

Limited new supply due to regulations.

High upside potential from value appreciation and operational performance.

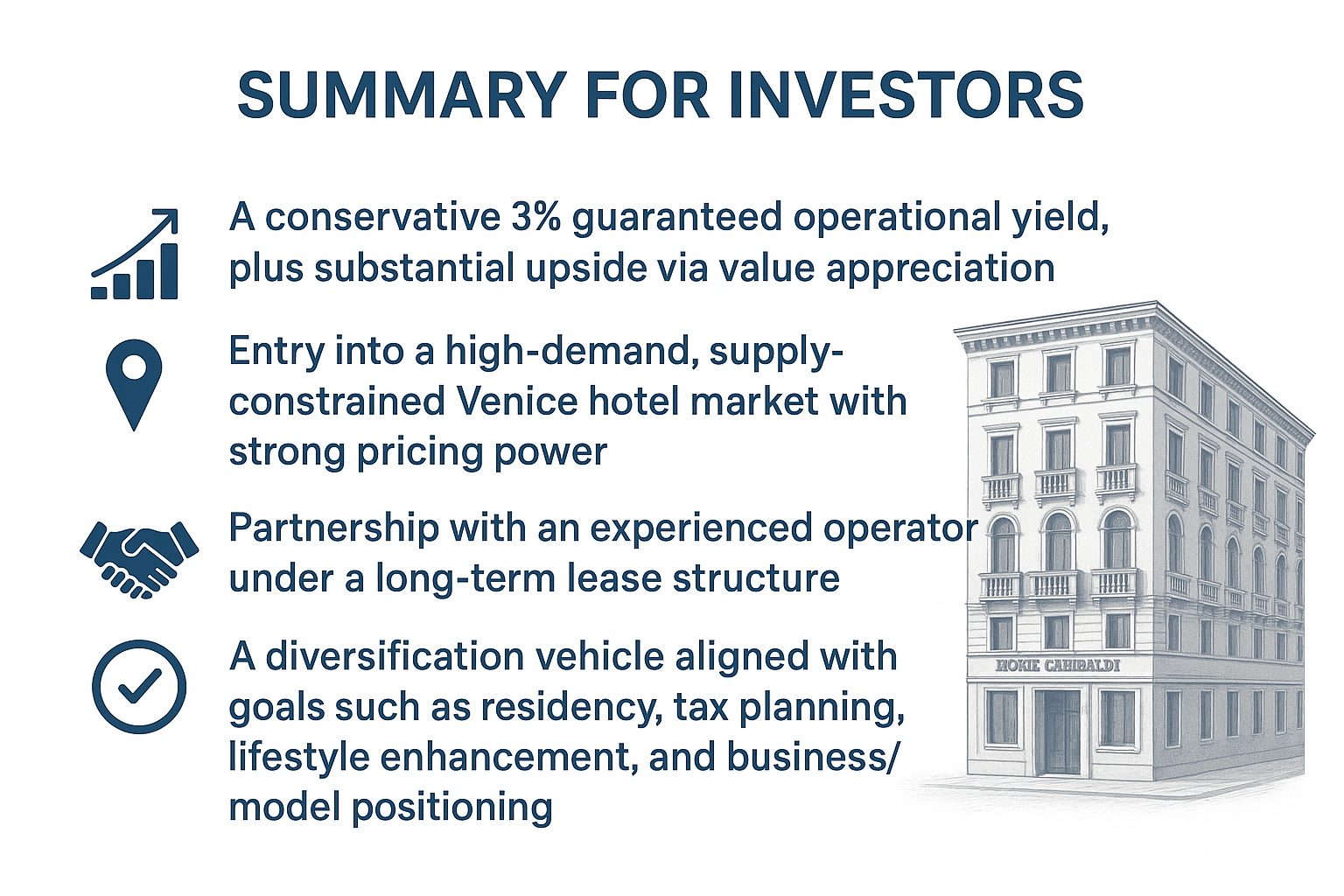

Attractive Entry & Structure: Fully equity-funded (€6 million), eliminating debt and enhancing capital security.

Guaranteed Return: 3% annual yield from hotel operations provides downside protection.

Upside Participation: Investors receive 40% of value appreciation upon sale.

Operational Security: 25-year lease (15 years firm) with a proven European operator.

Boutique Scale: 28 rooms – small enough for efficient management, yet substantial for strong returns.

Prime Tourism Location: Venice remains a global benchmark for high-value tourism and premium hospitality assets.

Growth Outlook: Sustained occupancy and ADR growth support future capital appreciation.

Key Investment Highlights

1. Pre-Investment Due Diligence & Structuring

Legal and financial review of the investment vehicle, shareholder agreement, and asset documentation

Verification of the renovation budget, project schedule, operator contract with Soho Boutique.

Assessment of Italian permitting, hotel licensing requirements, building heritage restrictions, and foreign-investor implications, including the use of Malta-based investment structures where applicable.

Scenario modelling including sensitivity analysis (occupancy drops, ADR variations, cost overruns)

HOW CITIZEN LANE SUPPORTS INVESTORS…

2. Access & Negotiation

Facilitation of access to the Hotel investment under preferred investor terms

Negotiation of investor protections (minimum return guarantees, performance clauses, exit mechanisms)

Optimisation of the investment structure for international investors (residency link, tax planning, asset holding structure)

3. Ongoing Operational Oversight

Monitoring of renovation progress, budget adherence, and timeline (6–12-month target)

Review of operator KPIs post-opening: occupancy, ADR, RevPAR, and operating margins

Reporting to investors and oversight of the guaranteed 3% yield payments

4. Exit Strategy & Value Realisation

Planning for the eventual asset sale: market timing, valuation, and buyer strategy

Advisory on value maximisation through refurbishment execution, repositioning, and branding enhancement

Coordination of profit distribution mechanics (40% of value appreciation) and tracking of investor returns

5. Residency & Wealth Structuring

Integration with European residency / Golden Visa pathways, cross-border tax planning, and long-term wealth structuring

Ensuring that the investment supports the investor’s broader personal objectives (diversification, lifestyle, mobility, business or branding goals)

ADDITIONAL DATA &

INVESTOR INTELLIGENCE

In Q2 2025, Italy recorded 189.3 million nights in tourist accommodations in the first half of the year (+3.1% vs 2024)

Italian hotels are in expansion mode: 64% have invested over 15% of turnover in the past 3 years, and almost half plan new investments in 2025–27 (sustainability, energy efficiency, digitalisation)

Venice ADR has shown significant post-pandemic growth, outperforming 2019 baselines

Alternative accommodation supply is rising in Venice, increasing the competitive advantage of well-positioned hotels with strong branding and service

Regulatory tightening in Venice (day-trip fees, limits on new hotels, heritage constraints) is reducing future supply and supporting the value of existing hotel assets

RISK FACTORS (WITH MITIGATION)

Renovation Risk

Potential delays or cost overruns during the 6–12-month refurbishment.

Mitigation: detailed project management, contingency budget, fixed-price contracts.

Operator Performance Risk

Hotel operator may not meet occupancy, ADR, or cost targets.

Mitigation: review Soho Boutique Hotels’ track record; include performance KPIs and exit clauses.

Market Risk

Tourism shocks (health events, global travel disruptions, regulation changes).

Mitigation: conservative 3% yield guarantee and upside linked to value appreciation.

Exit / Value Realisation Risk

Asset sale may take longer or achieve lower valuation.

Mitigation: proactive asset management, value-add execution, defined exit plan.

Regulatory & Environmental Risk in Venice

Historic-centre restrictions, lodging rules, sustainability compliance.

Mitigation: thorough regulatory due diligence and structural risk review led by Citizen Lane.